As of July 2023, you CAN deposit money orders into your own bank account using the USAA app. HOWEVER, not all money orders are the same. Some money orders (e.g. Walmart) have “do not deposit” printed on it. According to USAA, if the money order says “do not deposit” then using the app to deposit it into your bank account won’t work.

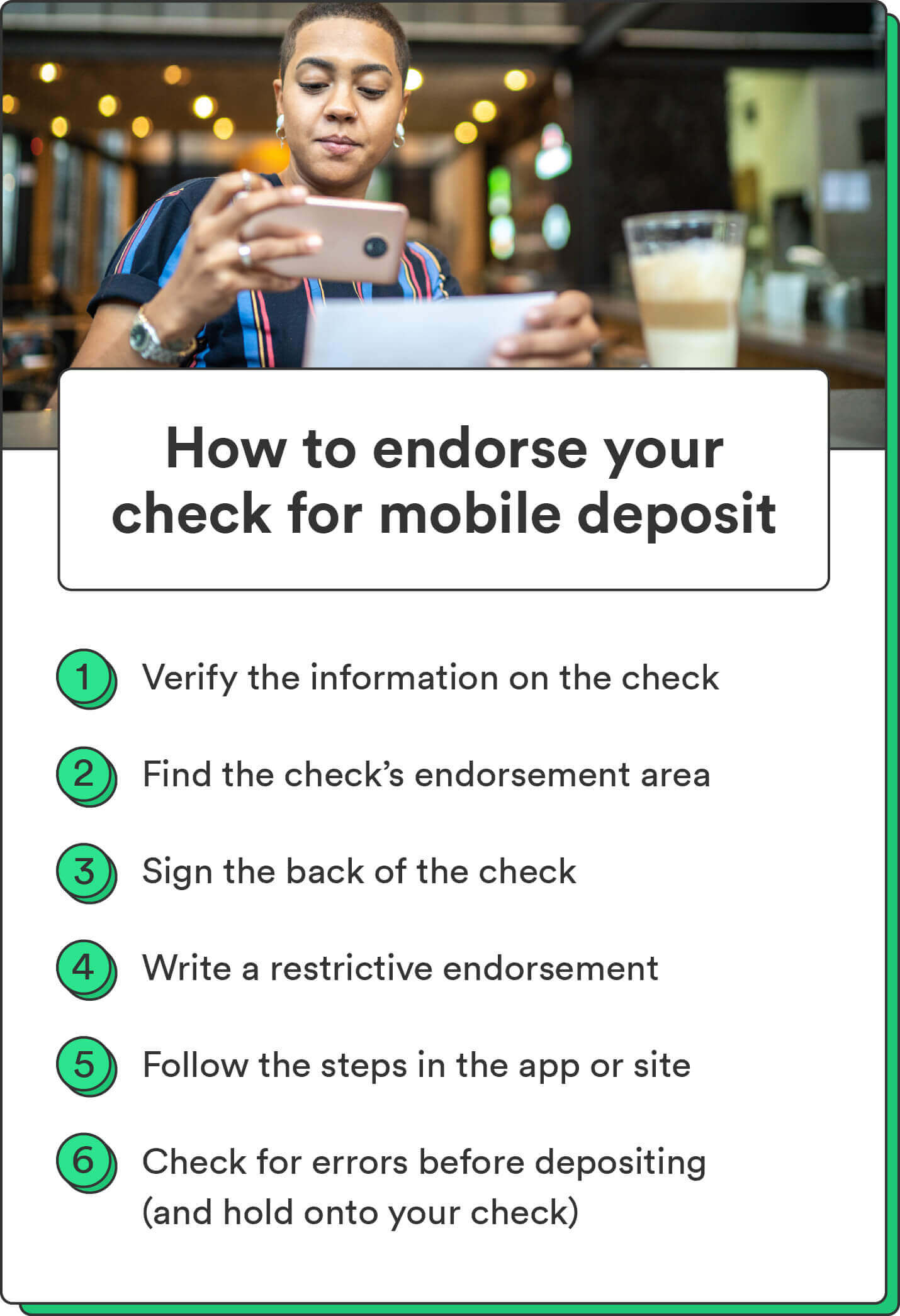

How to Endorse a Check for Mobile Deposit – Chime

1. Make sure your deposit information is correct, then select Deposit. 2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit. 3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

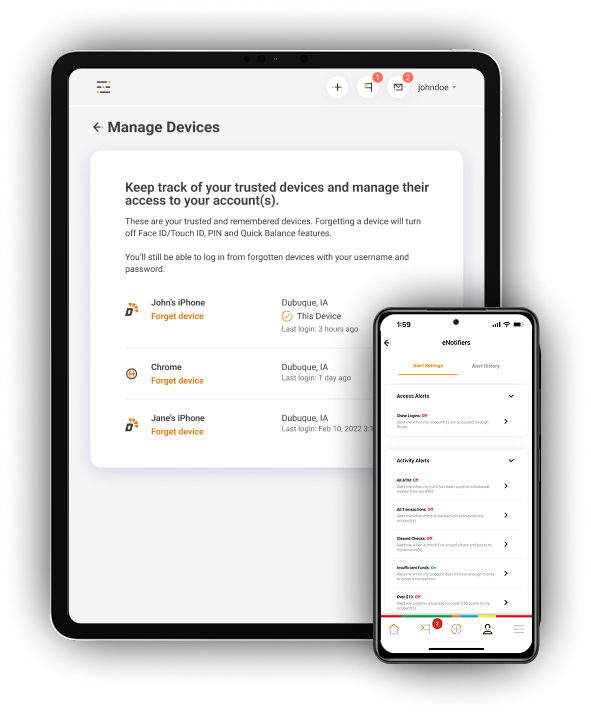

Source Image: dupaco.com

Download Image

Jun 2, 2023The answer is yes, you can! Depositing a money order through mobile banking is fast, convenient, and secure. In this article, we will guide you through the entire process, including the requirements and precautions to take.

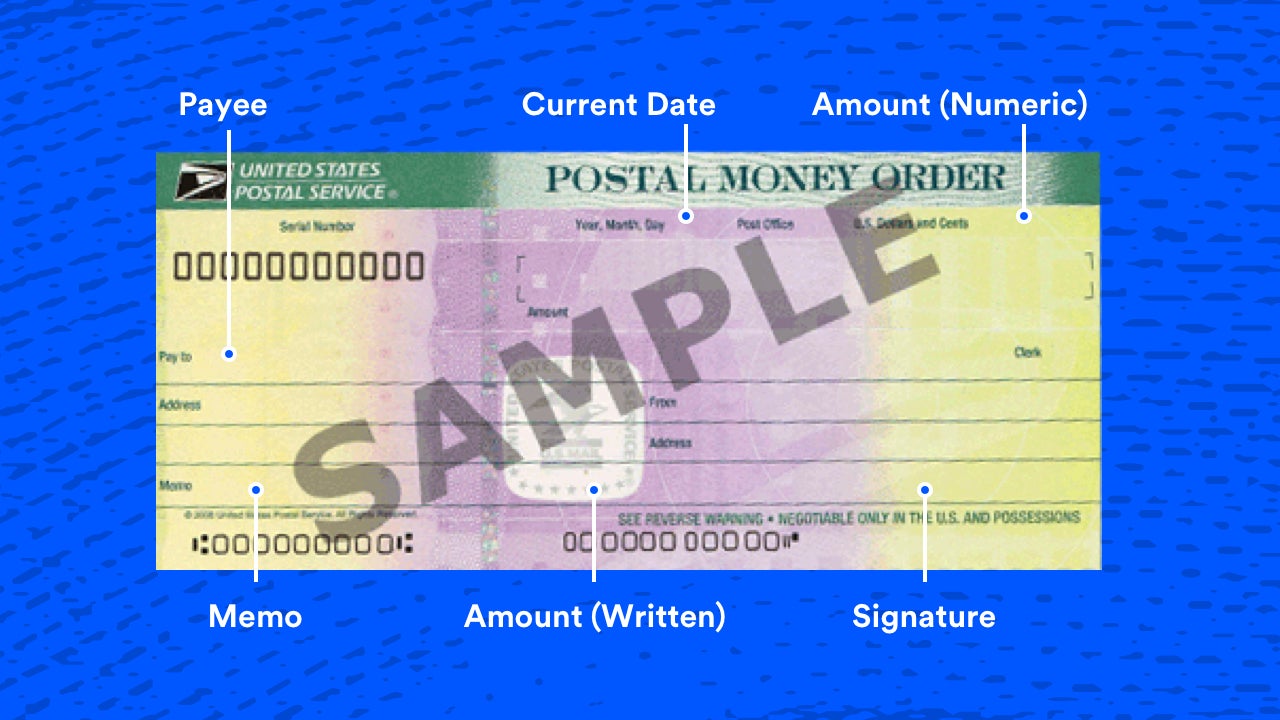

Source Image: bankrate.com

Download Image

What Does Payment Processing Mean and How Does It Work? Sign into your bank’s mobile app: Once you have your bank’s mobile app open, toggle over to the app’s mobile deposit feature. Select the account and enter the check amount: Choose the account into which you want your check deposited. You’ll also need to enter the amount of the check you’re depositing. Endorse the back of your check

Source Image: pcmag.com

Download Image

Can I Do A Mobile Deposit With A Money Order

Sign into your bank’s mobile app: Once you have your bank’s mobile app open, toggle over to the app’s mobile deposit feature. Select the account and enter the check amount: Choose the account into which you want your check deposited. You’ll also need to enter the amount of the check you’re depositing. Endorse the back of your check With Chase QuickDeposit, make a mobile check deposit almost anytime, anywhere with the ease of taking a picture. Another convenience of mobile banking.

How to Avoid Mobile Payment App Scams | PCMag

Dec 5, 2023Can You Mobile Deposit a Money Order? Source: The Street Also Read: Can I Get a Money Order With a Credit Card? So, now that we know a bit more about the payment method, let’s answer if you can mobile deposit a money order. The answer is mostly a yes. Specifically, many modern banks allow users to deposit checks through their mobile services. ✓ Can You Deposit Checks or Money Orders In Cash App? 🔴 – YouTube

Source Image: m.youtube.com

Download Image

68,666 Cashless Royalty-Free Photos and Stock Images | Shutterstock Dec 5, 2023Can You Mobile Deposit a Money Order? Source: The Street Also Read: Can I Get a Money Order With a Credit Card? So, now that we know a bit more about the payment method, let’s answer if you can mobile deposit a money order. The answer is mostly a yes. Specifically, many modern banks allow users to deposit checks through their mobile services.

Source Image: shutterstock.com

Download Image

How to Endorse a Check for Mobile Deposit – Chime As of July 2023, you CAN deposit money orders into your own bank account using the USAA app. HOWEVER, not all money orders are the same. Some money orders (e.g. Walmart) have “do not deposit” printed on it. According to USAA, if the money order says “do not deposit” then using the app to deposit it into your bank account won’t work.

Source Image: chime.com

Download Image

What Does Payment Processing Mean and How Does It Work? Jun 2, 2023The answer is yes, you can! Depositing a money order through mobile banking is fast, convenient, and secure. In this article, we will guide you through the entire process, including the requirements and precautions to take.

Source Image: hostmerchantservices.com

Download Image

How to Cash a Money Order | Huntington Bank View questions about: Show all | Hide all What types of checks are accepted with Mobile Check Deposit? We only accept checks from a U.S. financial institution, in U.S. dollars. 2 The following items are eligible for mobile deposit: Personal checks Business checks Government/treasury checks Cashier’s checks

Source Image: huntington.com

Download Image

What You Need to Know About Mobile Deposits | Chase Sign into your bank’s mobile app: Once you have your bank’s mobile app open, toggle over to the app’s mobile deposit feature. Select the account and enter the check amount: Choose the account into which you want your check deposited. You’ll also need to enter the amount of the check you’re depositing. Endorse the back of your check

Source Image: chase.com

Download Image

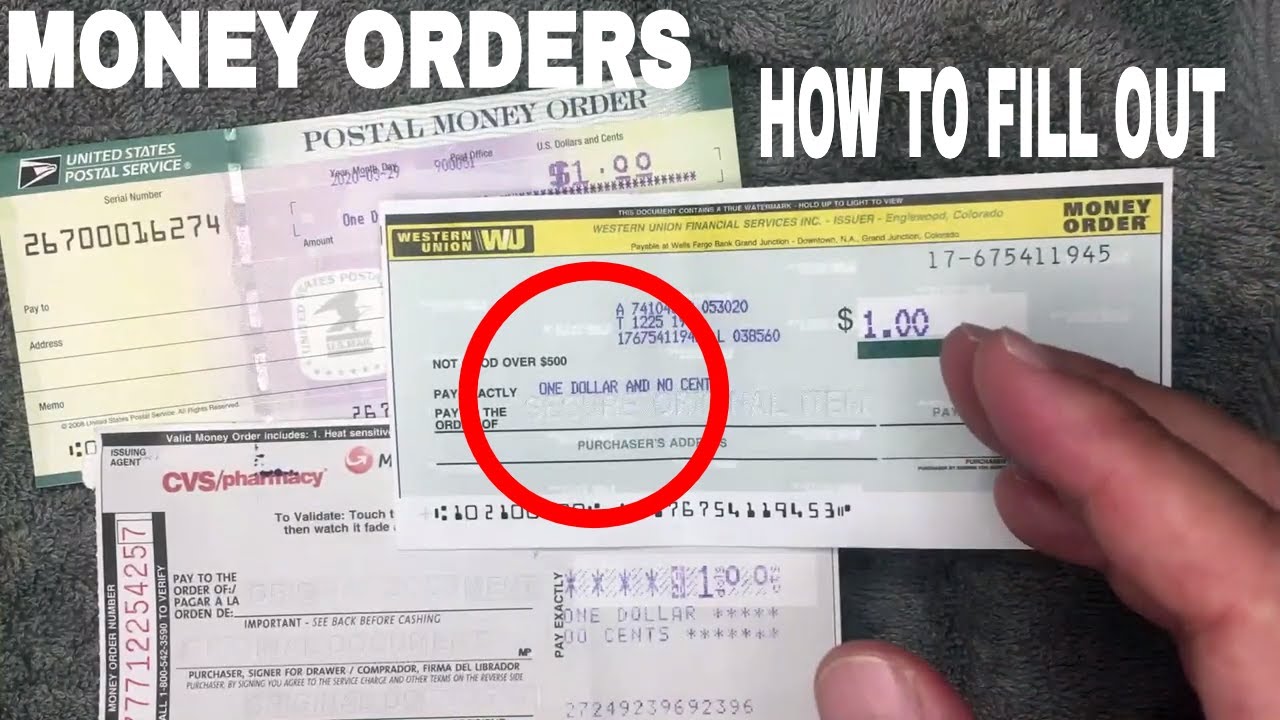

✓ How To Fill Out A Money Order 🔴 – YouTube With Chase QuickDeposit, make a mobile check deposit almost anytime, anywhere with the ease of taking a picture. Another convenience of mobile banking.

Source Image: m.youtube.com

Download Image

68,666 Cashless Royalty-Free Photos and Stock Images | Shutterstock

✓ How To Fill Out A Money Order 🔴 – YouTube 1. Make sure your deposit information is correct, then select Deposit. 2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit. 3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

What Does Payment Processing Mean and How Does It Work? What You Need to Know About Mobile Deposits | Chase View questions about: Show all | Hide all What types of checks are accepted with Mobile Check Deposit? We only accept checks from a U.S. financial institution, in U.S. dollars. 2 The following items are eligible for mobile deposit: Personal checks Business checks Government/treasury checks Cashier’s checks